Bitcoin treasury investors and observers are heading into 2026 with confidence, expecting public companies to hold significantly more bitcoin, expand digital credit offerings, and weather external pressures with balance sheets largely intact.

Corporate Bitcoin Treasuries Poised for Expansion in 2026, Survey Finds

That optimism comes through clearly in the first-ever audience survey conducted by , which gathered responses from individual investors, executives, and institutional participants closely tracking corporate bitcoin strategies.

According to the results, respondents overwhelmingly expect growth—not retrenchment—across the treasury sector. The most striking projection centers on total corporate bitcoin holdings. Survey participants noted that public companies collectively held nearly 1.1 million bitcoin after adding roughly 500,000 bitcoin in 2025.

Looking ahead, nearly one-third of respondents expect that figure to climb to about 1.7 million bitcoin by the end of 2026, while another 30.9% anticipate holdings reaching 2.2 million bitcoin or more. Only a small minority expects overall holdings to decline.

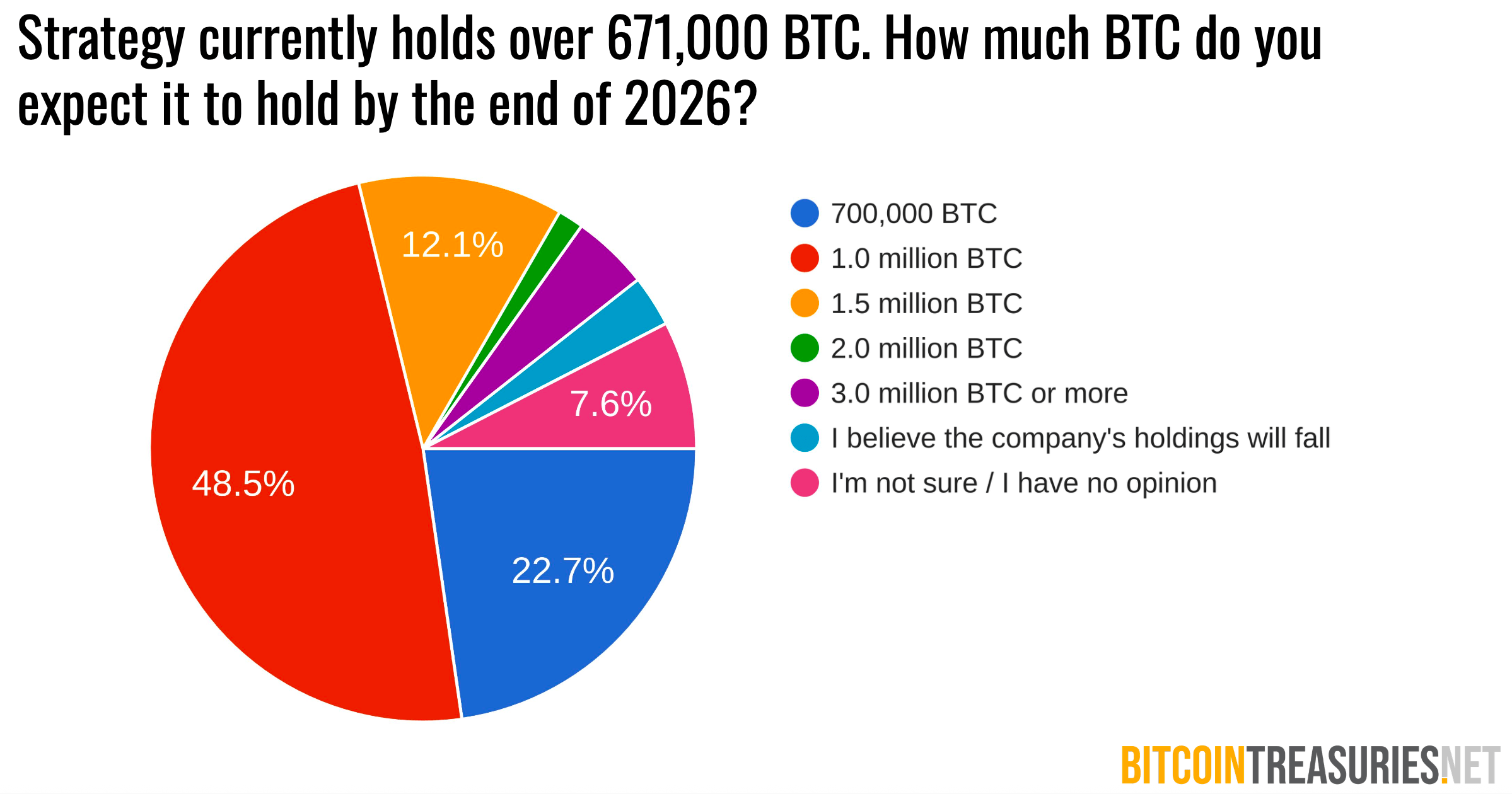

Company-specific expectations follow a similar pattern. Nearly 90% of respondents believe will increase its bitcoin stack, with the most common estimate placing its 2026 holdings near 1 million bitcoin. also drew strong support, with roughly half of respondents expecting the Japanese firm to meet or exceed its 100,000- bitcoin target by the end of 2026 and many projecting continued progress toward its longer-term goals.

Source: Bitcointreasuries.net 2025 Annual Survey Results

Source: Bitcointreasuries.net 2025 Annual Survey Results

The survey also suggests that optimism extends beyond balance sheets to equity performance. About 69% of respondents expect bitcoin treasury stock prices to rise year over year, and more than 80% believe those stocks will eventually recover to their 2025 summer highs—even if that recovery takes longer than a single calendar year. Investors appear patient, but not pessimistic.

One area drawing outsized enthusiasm is digital credit, including high-dividend preferred shares. More than half of respondents view digital credit as a complement to common treasury shares, while roughly one in six sees it as the superior option. Investors cited predictable, frequent dividends as more important than chasing the highest possible yield, a signal that structure now matters as much as return.

Also read:

When it comes to risks, respondents were clear about where their worries lie. Roughly 60% pointed to external pressures—, , prolonged market weakness, and media criticism—as the biggest threats to bitcoin treasuries. Internal concerns, such as companies selling bitcoin or slowing purchases, ranked far lower, suggesting confidence in management strategies remains intact.

Taken together, the findings point to a maturing sector entering 2026 with fewer existential doubts and a growing toolkit. If investor expectations hold, corporate bitcoin treasuries may spend the year doing what they do best: accumulating quietly while everyone else argues about the headlines.

FAQ ❓

- What is the BitcoinTreasuries.net survey? It is a 2025 audience survey measuring investor expectations for corporate bitcoin holdings, treasury stocks, and digital credit.

- How much bitcoin do investors expect public companies to hold in 2026? Most respondents expect total holdings between 1.7 million and 2.2 million or more.

- Which companies drew the most confidence from respondents? Strategy and Metaplanet received the strongest expectations for continued accumulation.

- What is digital credit in the context of bitcoin treasuries? Digital credit refers to preferred shares or similar instruments offering dividend income tied to bitcoin-focused companies.

Author: Jamie Redman

Source: Bitcoin

Reviewed By: Editorial Team