Following Friday’s spot bitcoin exchange-traded fund (ETF) activity, the numbers reveal that the 12 ETFs are on the brink of reaching the impressive milestone of 1 million bitcoins. As of this weekend, the funds are just shy of 42,000 BTC from hitting that target.

Massive Bitcoin Inflows Drive ETFs Closer to 1 Million Bitcoin Milestone

Nine months ago, the U.S. Securities and Exchange Commission (SEC) approved 11 spot bitcoin ETFs. With Grayscale’s Bitcoin Mini Trust now in the mix, the count has risen to 12. Before these approvals, Grayscale’s flagship Bitcoin Trust, known as GBTC, held around 620,000 BTC—a stash valued at $42.4 billion at current exchange rates. At the time, GBTC traded over-the-counter (OTC), but with the SEC’s greenlight, it transitioned into a publicly listed fund on the New York Stock Exchange (NYSE).

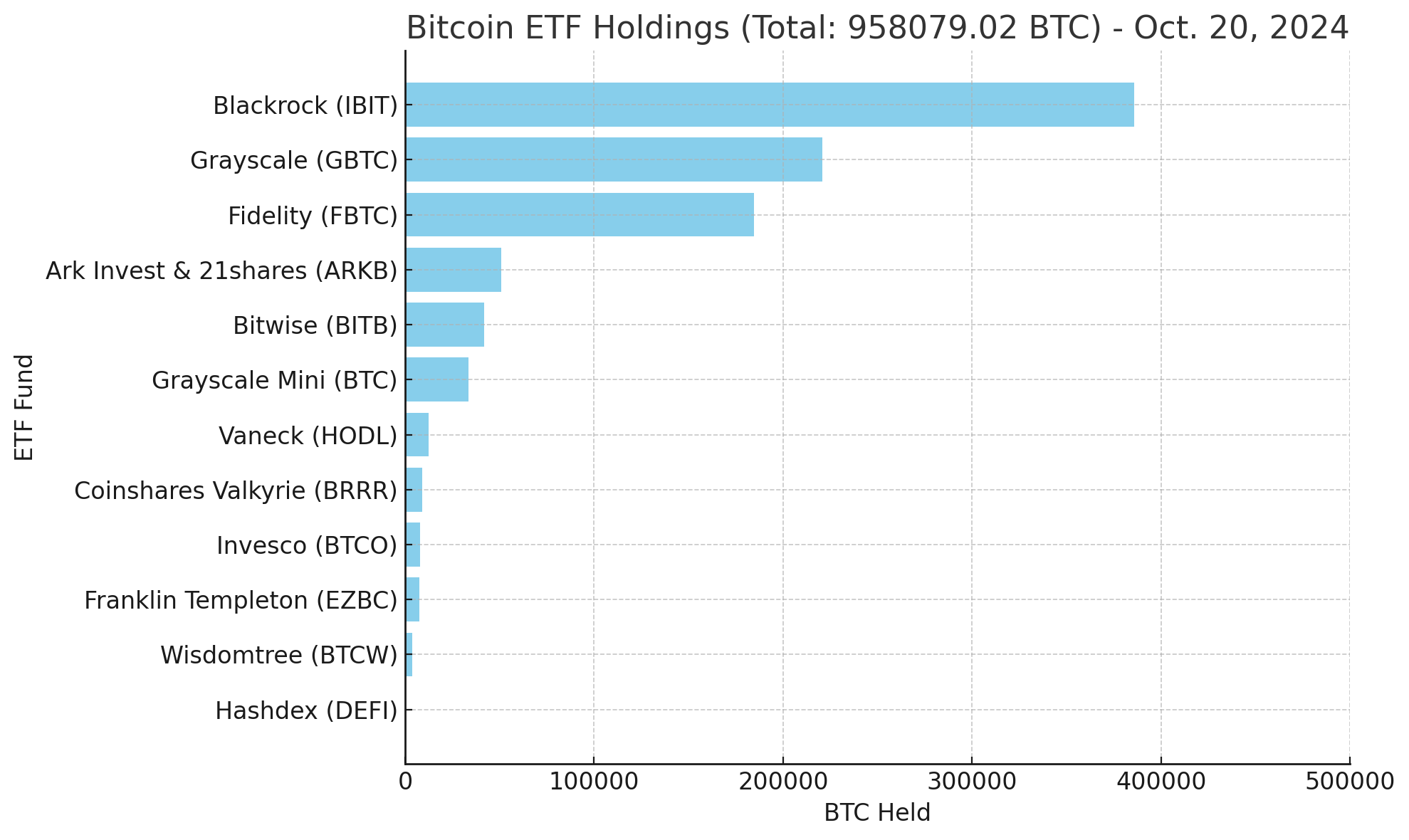

Grayscale also rolled out the Bitcoin Mini Trust (ticker: BTC), a new spot bitcoin exchange-traded product (ETP) with a notably lower fee than GBTC. Since its debut, this mini fund has secured its place as the sixth-largest BTC holder among the 12. At the forefront is Blackrock’s Ishares Bitcoin Trust (IBIT), which, since Jan. 11, 2024, has seen net inflows reaching a total of $22.84 billion. IBIT holds approximately 385,590.90 BTC, valued at $26.3 billion, based on current rates.

While Grayscale’s GBTC remains the second-largest BTC holder in this ETF lineup, it has faced significant outflows since going public. Currently, GBTC’s holdings are lower than that of the publicly traded company Microstrategy, which holds 252,220 BTC. GBTC now secures 220,821.30 BTC and has divested around $20.10 billion since its NYSE debut. Next in line is Fidelity’s FBTC, which has amassed 184,612.53 BTC, worth roughly $12.6 billion.

These three ETFs are the only ones with BTC holdings exceeding 100,000. Further down, Ark Invest and 21shares’ ARKB fund holds 50,749 BTC, valued at $3.4 billion, while Bitwise’s BITB fund commands a stash of 41,799.16 BTC, worth about $2.8 billion.

Following them is Grayscale’s mini fund, with 33,665.64 BTC, valued at $2.3 billion. The remaining funds hold under 15,000 BTC each. Vaneck’s HODL fund comes next, holding 12,500.69 BTC valued at $855.2 million. After that, there’s the Coinshares‘ Valkyrie BRRR fund, which holds 9,081.95 BTC worth $621 million.

Invesco’s BTCO holds 7,941 BTC, valued at $543 million, while Franklin Templeton’s EZBC has collected 7,421.64 BTC, valued at $507 million. Wisdomtree’s BTCW owns 3,747.21 BTC, valued at $256 million, and Hashdex’s DEFI fund secures 148 BTC, worth $10 million.

Altogether, these 12 funds collectively hold 958,079.02 BTC—just 41,920.974 BTC shy of reaching the coveted 1 million BTC mark. While that might not seem like a massive gap, at current exchange rates, it represents around $2.9 billion in inflows. Over the last six days, these funds have gained approximately $2.39 billion, suggesting that, if this pace keeps up, they could surpass the 1 million BTC mark in just over a week of open trading days.

Source: Bitcoin