Analysts are getting increasingly skittish about the mind-bending dollar amounts being plowed into the red-hot artificial intelligence (AI) sector.

The AI Bubble Anxiety: Why Bitcoin Is Falling

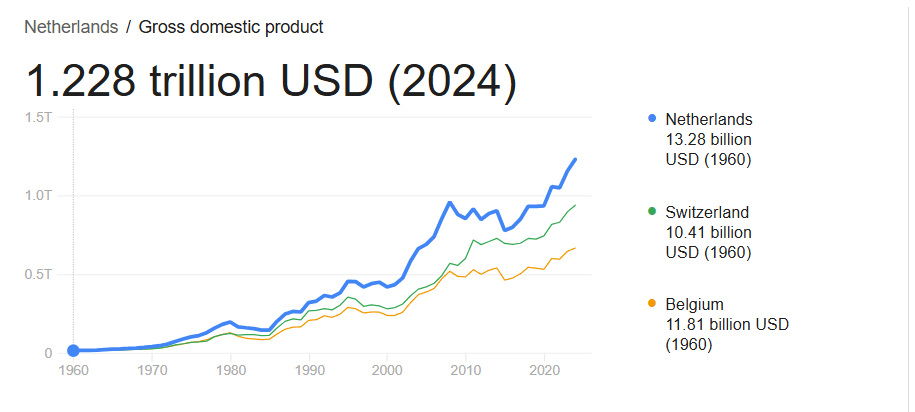

“We are looking at commitments of about $1.4 trillion over the next 8 years,” OpenAI CEO Sam Altman last week. That figure is almost $200 billion larger than the gross domestic product (GDP) of the Netherlands, a rich European country with 18 million people that was once a world power.

The comparison encapsulates the level of hype surrounding AI, and many believe the industry is now fully enveloped in an ever-inflating bubble that could burst at any time. The ensuing anxiety appeared to dampen sentiment around tech stocks and bitcoin on Wednesday afternoon, with the Nasdaq dipping 0.28% and the cryptocurrency shedding 2.36%.

(OpenAI’s CEO Sam Altman said his company has committed to investing $1.4 trillion in computing resources over the next eight years. That figure is nearly $200 billion more than the GDP of the Netherlands in 2024 / Source: World Bank)

(OpenAI’s CEO Sam Altman said his company has committed to investing $1.4 trillion in computing resources over the next eight years. That figure is nearly $200 billion more than the GDP of the Netherlands in 2024 / Source: World Bank)

In a bid to outdo the competition, OpenAI rival Anthropic, plans to sink $50 billion into building AI data centers in New York and Texas. This comes on the heels of a wave of other multi-billion-dollar AI investments by tech giants Meta, Alphabet, and Microsoft.

Read more:

But the dirty little secret behind these gargantuan investments lies in the details. The Wall Street Journal that it obtained financial documents showing that both privately held firms are bleeding money. Anthropic’s hemorrhaging is less pronounced, and the firm is on track to break even by 2028. OpenAI, however, will lose $74 billion that same year. The risk-on sentiment resulting from such projections may explain the driving force behind today’s sell-off in both tech stocks and bitcoin.

“In a world where AI can make important scientific breakthroughs but at the cost of tremendous amounts of computing power, we want to be ready to meet that moment,” Altman explained. “We plan to be a wildly successful company, but if we get it wrong, that’s on us.”

Overview of Market Metrics

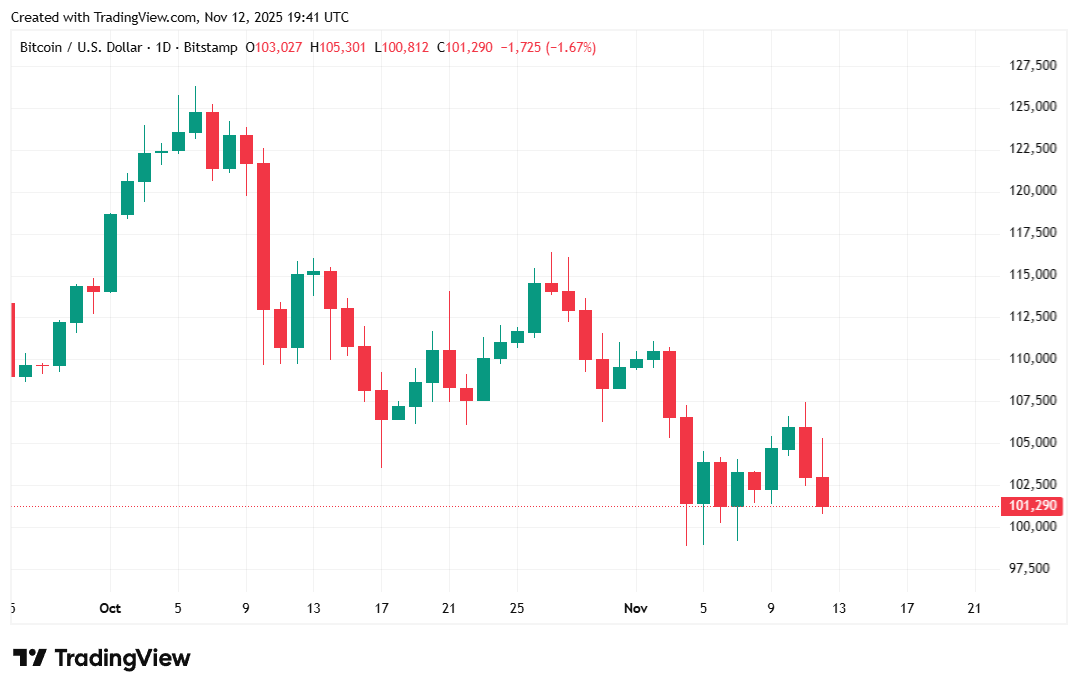

Bitcoin was trading at $100,950.39 at the time of reporting, down 2.36% over 24 hours day and lower by 3.19% on a weekly basis, Coinmarketcap data shows. The digital asset’s price has varied between $100,836.61 and $105,297.23 since Tuesday.

( BTC price / Trading View)

( BTC price / Trading View)

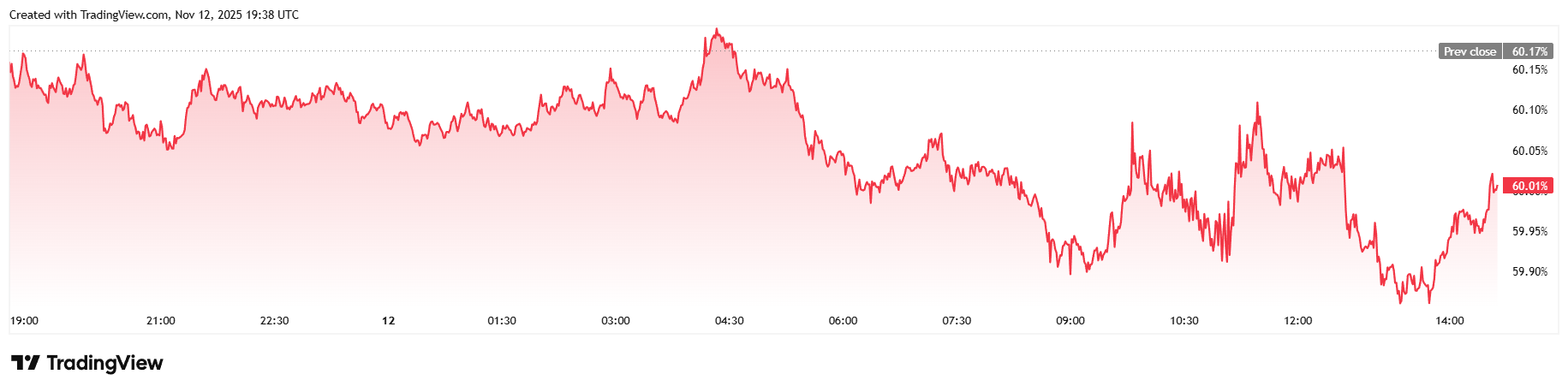

Twenty-four-hour trading volume was lower by 12.73% at $62.77 billion. Market capitalization fell to $2.01 trillion and bitcoin dominance eased 0.28% since yesterday to reach 60%.

( BTC price / Trading View)

( BTC price / Trading View)

The total value of open bitcoin futures contracts fell 3.58% to $66.14 billion over 24 hours, according to Coinglass. But liquidations rose to a total of $186.47 million, dominated by long investors who were caught off-guard by bitcoin’s retreat, losing $149.53 million in margin. Short sellers were largely spared, but the most bearish cohort saw $36.94 million wiped out.

FAQ ⚡

- Why is bitcoin falling again? Investor anxiety over a potential AI bubble and massive spending in the sector seems to have dragged both tech stocks and lower.

- What triggered the sell-off? Reports showing huge projected losses at OpenAI and Anthropic fueled fears that the AI boom may be unsustainable.

- How much money is flowing into AI? OpenAI’s Sam Altman said his company has received $1.4 trillion in commitments over the next eight years.

- How is bitcoin performing today? slipped 2.36% to around $101K as traders reduced risk amid AI-driven volatility and weaker market sentiment.

Author: Frederick Munawa

Source: Bitcoin

Reviewed By: Editorial Team