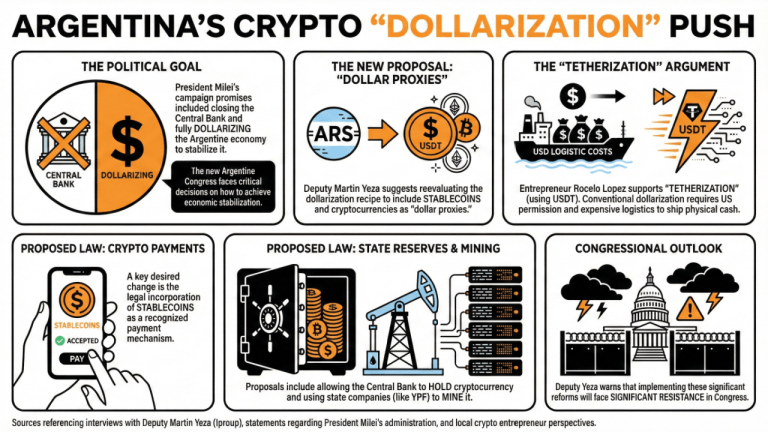

Martin Yeza, deputy of the new Congress, stated that stablecoins might fulfill a new pivotal role in the country’s payment structure. He considers that allowing the central bank to hold cryptocurrency and state companies to mine crypto would be positive. Local analysts also supported a so-called economic “tetherization.”

Argentina’s New Congress Might Give Crypto A New Push In 2026

The new Argentine Congress will have to deal with several critical cryptocurrency and stablecoin-related issues this new year.

According to Deputy Martin Yeza, the government will reevaluate the recipe for dollarization to stabilize the economy this year, with the inclusion of stablecoins and cryptocurrencies as dollar proxies.

Talking with Iproup, he :

If a series of reforms are implemented, we will face significant resistance, and those kinds of sessions will certainly not be well-received in Congress.

However, one of the changes he would like to see is the incorporation of stablecoins as a payment mechanism. He also considers that allowing the central bank to hold cryptocurrency and mine it through state companies, such as YPF, even if the government doesn’t take advantage of these possibilities immediately.

One of the key campaign promises of President Milei was to close the central bank and dollarize the economy to bring inflation numbers down.

Rocelo Lopez, a local crypto entrepreneur, supported a “tetherization” of the Argentine economy, referring to Tether, the issuer of USDT, the largest stablecoin by market capitalization.

For a conventional dollarization of the Argentine economy, the U.S would have to greenlight it, and associated shipping and logistics costs for bringing U.S. cash to Argentina would have to be considered.

A “tetherization” would offer benefits compared to a regular dollarization process without involving the U.S. government. Operations would be traceable and with low-cost transactions, Lopez stressed.

Recent reports reveal that Argentine banks are prepared to offer crypto services to their customers, and that the central bank is drafting a special measure to open the cryptocurrency market to private banks.

Read more:

FAQ

-

What key issues will the new Argentine Congress address regarding cryptocurrency?The Congress will reevaluate the use of stablecoins and cryptocurrencies as dollar proxies to help stabilize the economy in 2026.

-

What reforms does Deputy Martin Yeza advocate for cryptocurrency adoption?Yeza supports incorporating stablecoins as a payment mechanism and allowing the central bank to hold and mine through state companies.

-

How does Rocelo Lopez view the idea of “tetherization” for Argentina?Lopez advocates for “tetherization” as a flexible alternative to traditional dollarization, providing benefits like traceability and low-cost transactions without needing U.S. permission.

-

What developments are happening with Argentine banks regarding cryptocurrencies?Reports indicate that Argentine banks are preparing to offer crypto services and that the central bank is working on measures to open the market to private banks.

Author: Sergio Goschenko

Source: Bitcoin

Reviewed By: Editorial Team