World Assets, a subsidiary of the World Foundation, has sold $135 million in its WLD token to investors Andreessen Horowitz and Bain Capital Crypto.

Funding to Support World Network Expansion

World Assets, a subsidiary of the World Foundation, has announced the sale of $135 million worth of its native WLD token to prominent investors Andreessen Horowitz and Bain Capital Crypto. The sale, conducted at market price, is intended to help World Assets meet the growing demand for Orb-verified World IDs and support the global expansion of the World Network into the United States.

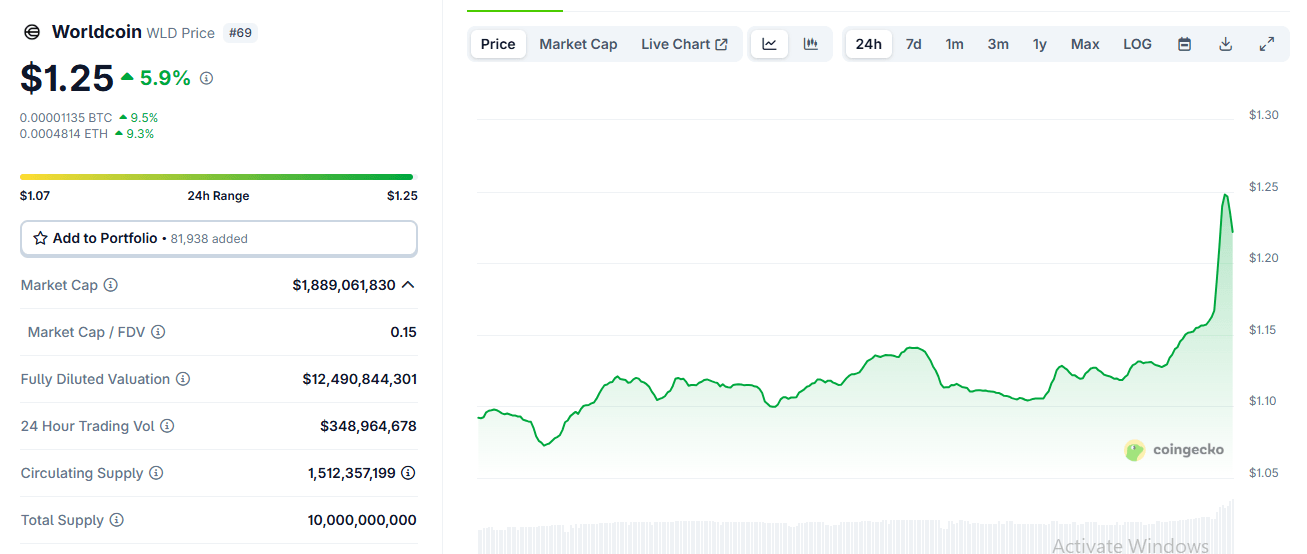

The announcement of the sale coincided with WLD’s mini rally, which saw the token’s price surge from just under $1.15 to $1.25 in under two hours. The transaction increased the circulating supply of WLD by more than 100 million tokens, while its 24-hour traded volume rose by more than 75%.

According to a May 21 statement released by World, the token sale to Andreessen Horowitz and Bain Capital Crypto builds on previous investments from notable firms, including Selini Capital, Mirana Ventures, and Arctic Digital.

With artificial intelligence (AI) rapidly evolving and blurring the lines between humans and machines, World believes the need to distinguish human from machine has never been greater. The company warns of profound risks across society if robust tools for verifying human identity in the digital realm are not put in place.

As outlined in the statement, the sale of millions in WLD to the two venture capital firms aligns with World’s long-term mission and is backed by dedicated builders who have supported the project from the start. The funding also positions World Network to become one of the first self-sustaining research programs.

World Network has experienced significant user adoption, with more than 26 million participants globally and over 12.5 million individuals possessing an Orb-verified World ID. This capital injection is expected to accelerate the project’s efforts to provide a verifiable digital identity solution in an increasingly AI-driven landscape.

Source: Bitcoin