Tether CEO Paolo Ardoino responded positively to an analyst’s $515 billion valuation of the stablecoin issuer, calling it “a beautiful number,” but ruled out the company going public.

Ardoino: Valuation ‘A Bit Bearish’

Tether CEO Paolo Ardoino has described an analyst’s $515 billion valuation of the stablecoin issuer as “a beautiful number.” He also suggested that the figure could be “bearish” as it does not fully account for the digital asset company’s bitcoin and gold holdings. Ardoino, however, intimated that he is looking forward to the next phase of the stablecoin issuer’s growth.

The CEO’s comments, shared via X, were in response to an assertion by fintech and crypto analyst Jon Ma that Tether’s valuation would surge if it followed in the footsteps of rival Circle, which listed on June 5. As reported by Bitcoin.com News, Circle’s stock marked its debut on the New York Stock Exchange (NYSE) by surging over 200% within 48 hours. At one point on June 6, Circle’s market capitalization stood at just over $30 billion.

According to Ma, the Tether valuation was derived using a financial model that “has Circle at $410 billion in Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) in 2025, or 69.3 times EBITDA.” Ma said multiplying Tether’s projected EBITDA of $7.4 billion by Circle’s 69.3 times EBITDA would place the stablecoin issuer’s valuation at $515 billion, making it the 19th largest company in the world.

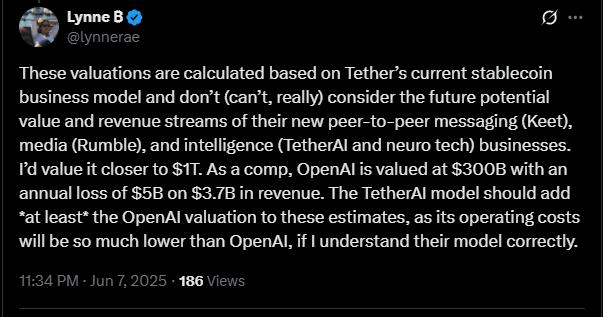

At that valuation, Tether would rank 19th globally and be well ahead of beverage maker Coca-Cola, and companies like Costco, and Oracle in market capitalization terms. The valuation would leave the stablecoin issuer within striking distance of Netflix and Mastercard, which are 18th and 17th respectively. Meanwhile, crypto advocates like Anthony Pompliano and Jake Mallers are even more bullish, with the former placing Tether’s valuation at $1 trillion.

Despite reveling at the projected valuation, Ardoino still downplayed the idea of Tether going public. He was responding to an X user who appeared to question the wisdom of going public.

“What benefits are there for Tether going public? Seems like Tether is thriving just fine privately,” the user asked.

However, one Tether critic questioned Ma’s valuation and slammed the attempt to assign value to an entity lacking transparency. The user added: “When that kind of opacity becomes the backbone of crypto liquidity, you’re not building a system, you’re running on borrowed belief.”

Still, other users cautioned Tether critics and Circle investors against comparing the two stablecoin issuers. One user suggested Tether has more credibility than its rival when it comes to defending the interests of its users.

“Circle investors think the companies are comparable but they are not. Circle barely owns BTC and does not mine, as Paulo mentions. Also, Tether has much more credibility in standing up for its customers against governments than Circle,” argued the X user.

Source: Bitcoin