Over the past seven days, about $450 billion has vanished from the crypto economy as it slid from $3.57 trillion on Nov. 10 to $3.12 trillion by 4 p.m. Eastern time on Monday. Even after a year filled with fresh all-time highs, plenty of tokens are now sitting a cool 25% to 50% beneath the lofty peaks they flaunted not long ago.

Major Tokens Fall 25%–55% From Highs in Weeklong Crypto Shakeout

dipped to $91,168 earlier today, marking its intraday low before clawing its way back a hair higher. It’s now hovering between $91,600 to $92,000, still sitting 27.1% beneath the all-time high (ATH) north of $126,000 set on Oct. 6, 2025.

( ETH) has taken an even harder hit, and it coasting along just north of $3,000, leaves it 39.3% below its all-time high of $4,946 logged three months ago in August. XRP has slipped 41.3% from its ATH, BNB is sitting 34.2% lower, and SOL has given up a hefty 55.6% from its peak.

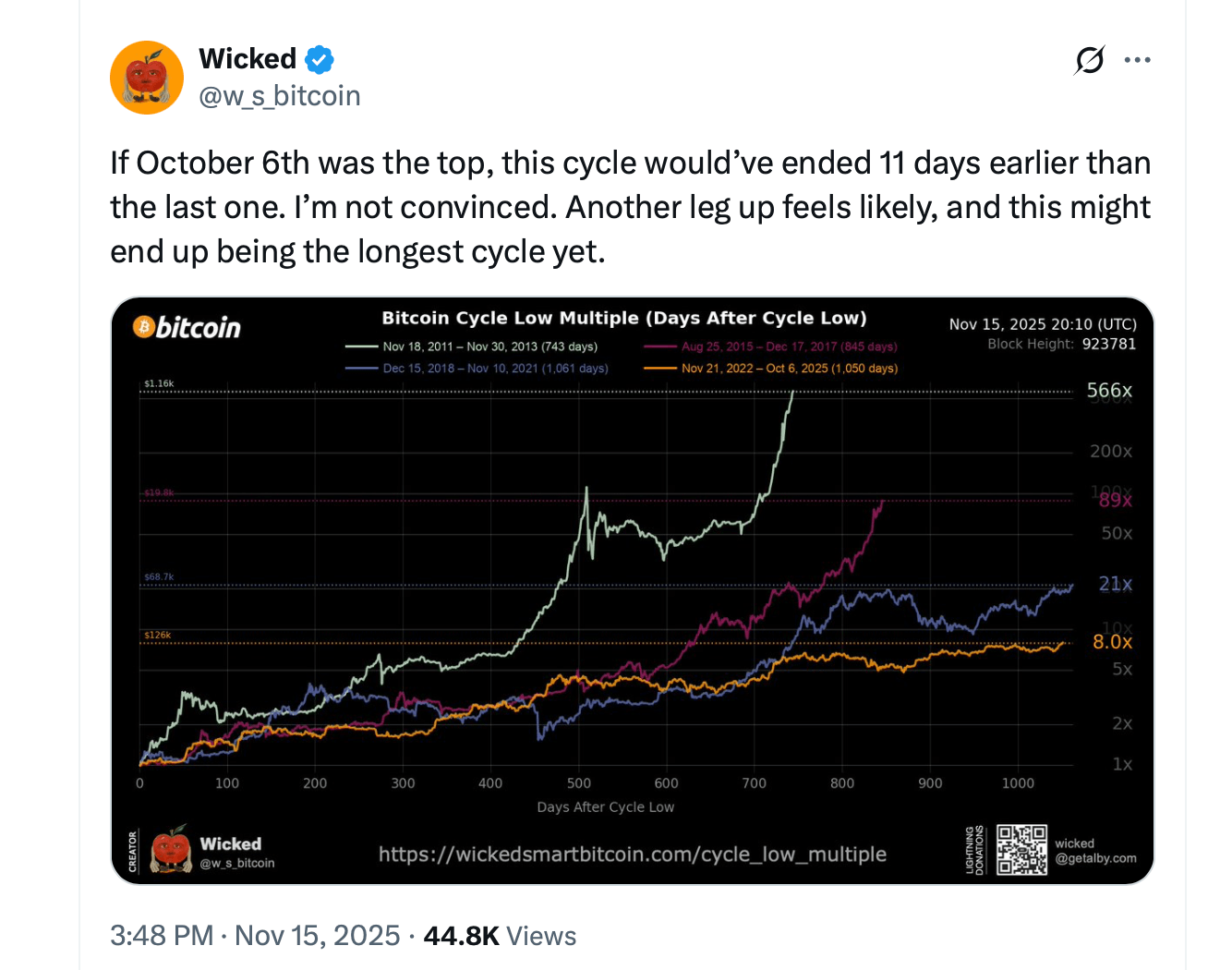

Despite the pullback, plenty of traders insist the bull run still has gas in the tank, with likely one more climb to the top in play. Pullbacks of 30% (or more) on major crypto assets — including bitcoin and especially the altcoin crowd — aren’t just common; they’re practically a signature move of earlier bull cycles, all the way to the final peak.

These dips squeeze out excess leverage, chill overly heated charts, and usually supply the dry powder for the next climb. The same rhythm played out in the 2013, 2017, and 2021 bull runs, with hefty drawdowns landing even as the broader uptrend held firm — and those pullbacks often arrived right before some of the most explosive parabolic phases on record.

Also read:

However, this downswing has slipped into bearish territory across nearly every timeframe and metric that has historically flagged cycle tops. The mix of technical breakdowns, institutional selling, and tightening macro liquidity paints a convincing picture that the 2025 blow-off top may have landed near $126K — and from here, the path of least resistance appears to be pointing downward.

In the end, the market looks split between déjà vu and denial. History has shown deep pullbacks can be the prelude to fireworks, but the current stack of warning signals suggests the music may have already stopped. Whether this is just another classic shakeout or the early chapters of a broader and long comedown, traders are bracing for a market that seems determined to keep everyone guessing.

FAQ ❓

- What caused the $450B crypto market decline? A week of heavy selling, macro tightening, and technical breakdowns pushed major assets sharply lower.

- How far is bitcoin from its all-time high? is trading just above $92,000, about 27% below its October 2025 peak.

- Which altcoins saw the steepest declines? , , and logged drops ranging from 34% to more than 55% from their record highs.

- Is the crypto bull run officially over? Traders are divided, with some expecting another climb while others warn signals point toward a deeper downtrend.

Author: Jamie Redman

Source: Bitcoin

Reviewed By: Editorial Team